Will You Have Enough for Retirement?

Will You Have Enough For Retirement?

In my seminars and courses, I always talk about running out of money before you run out of life. Do you ever ask the question; Will you have enough for retirement?

You see, most people really don’t plan for retirement properly. Sure, they may have an IRA or a 401K or a 403B or maybe even a day-trading account or an account full of mutual funds. But most people just don’t know what to expect in retirement or how far their money will take them.

And you know what? It’s not even their fault. It’s complicated to properly plan for retirement. Here is a video I recently recorded about Retirement Accounts.

Here Are Some Facts

First, you will statistically live 23.3 years after you retire. If you retire at say 61 or 62 years old, you will live close to your 85th year. Problem is, you may outlive your money if you live that long.

But that’s not even the critical part. The critical part is that second, you won’t be able to sustain the lifestyle that you want because of the risk of running out of your money in retirement.

Let’s look at how financial planners study this scenario.

Financial Planners Scenario

A good rule of thumb is that you can take out about 4% of your retirement savings every year, if your assets are allocated to a 50/50 portfolio of stocks and bonds. That means if you have $1,000,000, you will be able to live on $40,000 a year. And if you do it that way, you probably won’t run out of money in retirement. You may even be able to leave some to the kids or to charity.

So if $40,000 a year is enough for you to live on in retirement, then you can stop reading now if you have $1,000,000. But if you don’t have $1,000,000 OR you don’t think $40,000 is enough, then keep reading.

How Much Will You Need

Think of it this way, if you want to be able to live on $100,000 per year in today’s money, you will need $2.5 million. AND, there must be zero inflation and zero taxes eating away at that $2.5 million and its yearly payment.

So, probably still not enough, right?

Keep in mind, that also means that you will be left with no money when you’re 85 years old — exactly when you will need it most. You see, we spend 90% of health-related expenses in the last 10% of our lives.

Now, I’m not sure how old you are or how many years you have until retirement, but I always recommended you start now or the scenario above will get worse.

So, what can you do?

2 Things That You Can Do Right Now:

- Invest more, and/or

- Maximize the return on your investments.

Most people may be able to invest a little more, and that is certainly up to you. The more the merrier.

But it won’t really matter as much if you invest properly and maximize the return on your investments. For you to understand the difference in your retirement, you should understand that there are probably things that you may not know about investing that are hurting you.

For example, most people on Wall Street will tell you that if you are getting a 6% overall return in your portfolio, you are doing fantastic. As a result, if last year you did better than 6%, you were probably feeling pretty good about your retirement income. The problem is, there is so much that you may be leaving on the table.

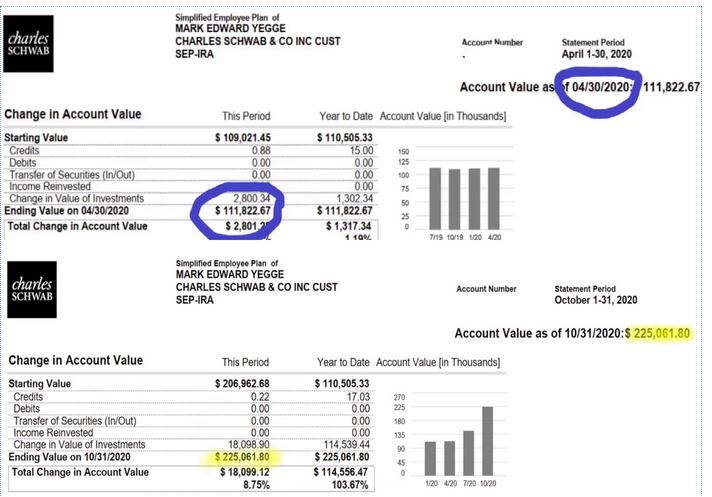

For example, in my investors mastermind group, I have one guy that made 54% in 6 months. In one of my IRA accounts, I made 124% in 7 months. In one of my hedge funds, we made a 139% return for the year.

Keep in mind it was an up year, but you want to know the really great thing about these results? We didn’t even increase the amount of risk that we took. In fact, we lowered risk compared with some of the betas that even the best mutual funds get.

That is an important key in getting maximum returns for retirement: lower your risk!

I’ll say it again, you must lower your risk!

Show Me The Money

There is a huge difference between making 6% a year vs. making 2% a month (as most of our mastermind members do). For illustration, $500,000 invested for 15 years would become:

6% per year: $1.2-million

2% per month: $17.6-million

More importantly, below is how much you could take out each year (at 4%) and still not run out of money in retirement:

6% per year: $48,000

2% per month: $704,000

The difference in getting average returns and getting stellar returns (without cranking up your risk) is an income of $656,000 PER YEAR! That is how much you are leaving on the table EVERY YEAR. Think of the difference in your retirement lifestyle if you could make that one adjustment. In my investors mastermind group, I show you how you can do just that.

For more information, check out this recent video I recorded on the subject.

To your success (in retirement)!